CFA® Level 3 Exam Post-mortem

July 25th, 2018

Just over thirty days ago I sat the CFA® Level 3 Exam. I’ve been applying to job openings ever since. I of course do not have my score, rumours online have the exam results being released August 28th, but in the mean time with my new found free time I go to the gym, despite a bad knee injury, and try to whittle away at my ta-do list, including plans to update this blog and my CFA flashcards blog.

Victory!

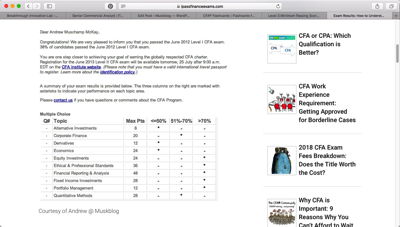

Apparently I finally mastered the CFA Curriculum or at least the exam format as I passed the Level 3 exam on my first attempt. I’ve of course been applying to new jobs since I wrote my final CFA exam, but I’ve yet to have one interview. I’ve also been updating this website and now that I never have to study for a certification exam again, knock on wood, I’ll probably finally get around to fixing and updating many things on this website.

It took me a long long time, but I did complete the CFA Program and earn the Charter. I think the day it was officially granted was August 25th 2022 but apparently the email got lost so I’m still waiting for my piece of paper but I have updated my resume and LinkedIn.

The Answer is Flashcards

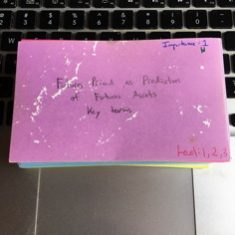

Last year I typed up a list of all the flashcards I was studying right up until exam day, this year I planned to do the same thing, but first I had a few more general thoughts. If I had to rewrite I would of course start with any newly added material, but I’ll also start with the flashcards linked to below, questions I’ve collected, and whatever material I did worst on during the actual exam along with the most dreaded material which for Level 3 may be currency hedges with options such as collars or swaptions.

Online material provided by the CFA Institute

The CFA Institute changed their website, they may have changed it for the 2017 December Level 1 exam, but now the online practice problems and exams are handled differently. You no longer can just redo an individual item set, in fact if you want to redo any of the item sets you have to blow away all your scores, which I was unable to do using Safari. The CFA Institute has also added gameification to their online study materials. I earned several badges, there may even be badges for passing the actual exams which I can add to my social media profiles.

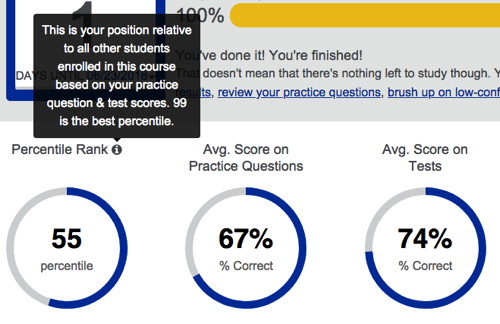

Compare Yourself to your Peers Competition

The best new feature of the CFA Institute website is your performance is ranked and compared to other candidates. I redid all the online problems in the two weeks before the exam and my score and ranking gave me confidence that I should pass, but the morning portion is considered the most difficult part of the Level 3 exam and I will just have to wait and see, hoping my months of studying and long run average are sufficient.

Stay Off Social Media

According to Mark Meldrum the CFA Institute has been paying close attention to social media, hopefully including non-English social media, and a reckoning is coming. I just want to post a few images after months of studying, hopefully this is “OK”. Hopefully they won’t immediately get stolen, I mean if you’re an expert in passing the CFA exam why don’t you have an image of your email confirming you passed the CFA Level 1 exam, why use mine?

Now in 2022, it seems at least for charterholders if not candidates the CFA Institute is encouraging the use of social media especially LinkedIn, which I find more than a little ironic given all the grief blogging about the CFA program brought me.

Your real competition is yourself

The screenshot I was worried about is below. I took it the evening before the exam, don’t steal it! My interpretation of the data was if I just maintained my average performance I would pass the exam. I think this is good information for a candidate to have. Confidence is very important to passing. Previously you could calculate you scores in practice problems and exams, and I of course did, but you had little data comparing yourself to other candidates.

Don’t Panic

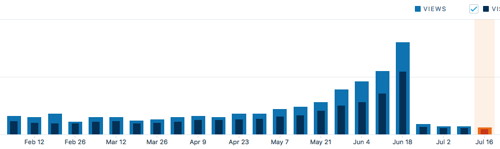

I also took a screenshot of the WordPress analytics for the my collection of flashcards. Traffic increases every week starting in April then after the exam, traffic falls completely off a cliff. Level 1 candidates do the most panicked searching so traffic will pick up the most prior to when Level 1 candidates write.

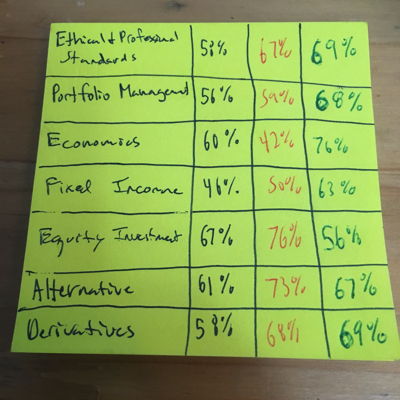

Know your strengths and weaknesses

Just in case I get in trouble for my screenshot, I also made an Excel file of my practice exam performance and kept track of my performance on a sticky which I then photographed with my iPhone, but honestly if 54% of candidates pass and I am supposedly in the top 45% I should have a solid chance to pass right?

My strength after eight months of studying was Equity Investments so I re-did those problems last and ended up doing considerably worse, but I probably shouldn’t have still been awake doing practice problems at that point in time. Hopefully I got a decent night’s sleep and did well enough on the actual exam. I focussed on speed in the morning, I know I did not get them all correct but I at least wrote something in all the boxes. In the afternoon I had time to double-check about two thirds of the problems, I’ve since lurked in some forums online and the consensus was the exam was hard and people are hoping the Minimum Passing Score is in the low 60s.

Still a CFA Candidate?

I still don’t recommend blogging about being a CFA Candidate, apparently people who are supposedly experts in passing CFA exams will liberate your images. Maybe I gave permission but in 2018 after all the crap I’ve been through I’m rescinding my permission if I did in fact give it. Maintaining a blog as long as I have is far from easy, don’t let the social media experts who have been doing it for 2-3 years tell you otherwise.

Worrisome CFA Level 3 Material

- Futures Priced as Predictors of Futures Assets Key Terms

- Convenience Yield

- In a swap the floating side duration is:

- A risk reversal

- Expected Excess Return (formula)

- The Macaulay duration is…

- Insurance Perspective Theory

- Basis point value (BPV)

- RVPI

- The amount of credit risk for an over-the-counter option is:

- The correlation of expected defaults on the collateral of a CDO affects:

- The money duration is…

- Cyclically Adjusted P/E Ratio (CAPE)

- The pay-fixed, receive-floating swap has ____ duration because:

- Total Return on a Commodity Future [formula]

- Seagull Spread

- Equity q

- Decomposing Expected Fixed-Income Returns (formula)

- Expected Change in price based on investor’s view of yield and yield spreads (formula)

- Butterfly Spread (formula)

- Empirical Duration is…

- The theory of storage explains…

- Approximate Holding Period Return for a Bond using Effective Duration (formula)

- Black-Scholes-Merton Model & “Greek Risk”

- Singer-Terhar formulas

- Investment-grade bonds & high-yield bonds and their sensitivities and risks

- The strategy of riding the yield curve is one in which a bond trader…

- High-yield bonds and their exposure to interest rate risk

- Modified duration is…

- Spread duration for high-yield bonds VS investment-grade bonds

- Bond Duration Definition and Formula

- Summary of the Singer-Terhaar approach:

- Credit Spread Risk

- Notational principal needed to close the duration gap on an interest rate swap (formula)

- Approximate excess return on a credit security (formula)

- Five Stages of the Business Cycle + Attractive Investments

- High-yield bonds and credit loss rates

- Tobin’s q

- Straddle trade

- 5 basic principals of new Prudent Investor Rule

- Asset Manager Code of Professional Conduct 6 General Principals

- GIPS requires in order to claim compliance…

- Standard III(E) – Preservation of Confidentiality covers which clients?

- Section E, Performance and Valuation of the Asset Manager Code calls for…

- What are the key factors that a trustee should consider when investing and managing trust assets?

- What are the 6 parts of the CFA Code of Ethics?

- According to the Asset Manager Code the compliance officer should report to:

- Negative Skewed Distributions

- Compute portfolio standard deviation of return only two assets

- Type I and Type II Errors in Hypothesis Testing

- What are the properties of a normal distribution?

- Positive Skewed Distribution

- Representativeness Bias

- 3 Growth Accounting Relations

- Emotional Biases and Cognitive Errors

- Difference Between Cognitive Errors and Emotional Biases

- During asset bubbles investors often exhibit symptoms of which bias?

- Risk Aversion VS Loss Aversion

- Visual Guideline for Determining a Behaviourally Modified Asset Allocation

- The two types of Cognitive Errors are:

- Ballard, Biehl & Kaiser 5-Way Model Archetypes

- Output Gap

- Fed Model and equity markets

- Michael Pompian Behavioural Investor Types

- Taylor Rule Formula

- Availability Bias

- Myopic Loss Aversion

- Fed Model and long term government treasury yields

- 4 approaches to forecasting exchange rates

- An active accumulator…

- The Permanent Income Hypothesis

- Under Expected Utility Theory Individuals…

- Covered Interest Rate Parity (CIRP)

- Neoclassical Growth Theory

- Growing output gap between actual GDP growth and the potential GDP growth may cause…

- Conservatism Bias

- 3 possible reasons rebalancing earns a positive return

- Holdings-based style analysis Pros & Cons

- Ballard, Biehl and Kaiser 5-Way Model

- 5 methods to use leverage to increase portfolio returns:

- Situations that could cause upward bias in the calculation of Sharpe ratios are:

- Straddle

- GIPS definition of internal dispersion

- If you will receive foreign currency in X months and fear the foreign currency will weaken you should…

- The maximum profit from a collar position is?

- Returns-Based Taxes: Accrual Taxes

- The 4 Equity Monetization Options are?

- Segmented Value-Added Return (formula)

- A valid benchmark should be:

- Leveraged Portfolio Return (formula)

- Box Spread

- The steps of the risk management process:

- Return over maximum drawdown (RoMAD)

- Relative Return Performance of Different Strategies in Various Markets

- Under GIPS what is considered a real estate investment?

- An equity forward sale contract is…

- A returns-based benchmark is:

- 6 Criticisms of Mean-Variance Optimization

- Annualized VaR from n-day VaR (formula)

- Incremental return contribution of the asset category (benchmark) investment strategy [formula]

- Summary of the Advertise-to-draw-liquity trading strategy

- Amount needed to be invested into bonds to create a Synthetic Index Fund (formula)

- Maximizing active return given a level of active risk and risk aversion (formula)

- If you will pay foreign currency in X months and fear the foreign currency will strengthen you should…

- Under GIPS firms must disclose the presence, use and extent of leverage, derivatives, and short positions if material including…

- Human Capital Equation

- A needs-trustworthy-agent focus is appropriate when?

- A new IPS should include the following components:

- Sector/quality effect:

- An independent (or private) foundation is:

- Marginal Contribution to Total Risk (MCTR) [formula]

- Direct market access is most suitable for trades which are:

- Liquidity at any cost…

- If you’re expecting a parallel shift up, the appropriate strategy is to:

- A Portable Alpha Strategy:

- A performance quality control chart has 3 criteria:

- Returns-based style analysis Pros & Cons

- To prepare an Investment Policy Statement a Financial Management Professional must access:

- Required number of futures contracts given BPVs (formula)

- A total return equity swap is…

- Disadvantages of volume-weighted average price (VWAP)?

- Mean-Variance Optimization formula

- A long position in cash is equivalent to…

- Return Due to Style and Active Management (formula)

- Optimal Allocation formula for a single risk-free and a single risky asset

- When advising emotionally biased investors, advisors should focus on:

- Sell Convexity Strategy

- The sensitivity of the futures price to a yield change (formula)

- Risk-Adjusted Return on Capital (RAROC)

- To go from a monthly VAR to a weekly VAR you must:

- Returns Based Taxes: Accrual Equivalent Return

- The incremental return contribution of the investment managers (formula)

- M2 “M Squared”

- The Disposition Effect

- Optimal Corridor VS Volatility

- Transaction Risk

- Limitations with using the Sharpe ratio for hedge funds:

- The GIPS standard and accounting requirements

- Under GIPS what is not considered a real estate investment?

- The notational principal of a swap necessary to change the duration of a bond portfolio (formula)

- The essential relationship for full interest rate hedging (formula)

- Calculating Value Added (by Fund Managers)

- Sortino ratio

- A forward conversion with options involves…

- Misfit Active Return

- CPPI Target investment in stocks (formula)

- Which of indexing, enhanced indexing, and active investment management tends to have the higher information ratio?

This post was a lot of work, I’m not sure it was worth it, especially considering I keep discovering my content on other websites. I really do not want to spend another year studying for the CFA exam and I’m long overdue for a new job so you might as well look at my resume if you’ve read down this far.

It is always too early to quit

Google is your friend. I collected several lists of other CFA Candidates who blogged. Some completed the program, some abandoned their blogs because it is so much extra work and honestly I have not seen a positive ROI. In 2019, I have been revising and improving my blog, trying to make it more timeless and future proof. I’ve also taken a fresh look at the web analytics so I have an even better idea of which flashcards are popular every year and which are being frantically reviewed just before the exam. I suspect I must now update that post annually, but the list above is some of what I studied when I passed the CFA Level 3 exam.

If you have thoughts on the CFA Program you can leave them below but this is not one of my most popular CFA blog posts. Hopefully, it is of use to someone because I spent far too much time and effort on the CFA Program and this blog.

This entry was originaly posted on , it was last edited on and is filed under: Advice and tagged: CFA®, Finance, Flashcards.