CFA® Candidates Shouldn’t Panic

May 31st, 2017

In addition to maintaining the mighty Muskblog I also typed up all my personal CFA® flashcards on yet another WordPress blog. This gives me extra insight into what formulas, theories, and definitions CFA Candidates are frantically Googling.

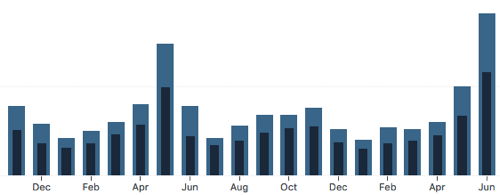

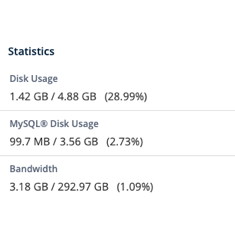

My data is definitely biased. For instance, this data depends on which of my flashcards perform well in search engines relative to all the other CFA, finance, accounting, and mathematics websites online. The Internet just keeps getting bigger and the CFA Curriculum changes every year so I actually recommend you consult this list of popular flashcards.

Valuable Free Advice

In addition to having given away entirely too much study material for free, I’ve also given free advice. Now I’m trying to further improve the quality of this blog and employ more modern search engine optimization techniques despite that I can not recommend blogging while a CFA Candidate.

I believe my advice for future MBA students was to not let other students panic you. There always seems to be more than one Chicken Little in any sufficiently large sample of students.

Keep Studying

I think I’ve met more ex-CFA Candidates than people who have achieved the Charter. When I think back to study groups and review classes most of the people didn’t pass. Any examination of annual pass rates will confirm my sample is reflective of the entire population of Candidates. I don’t know why they didn’t pass or why they gave up, but I do know I rewrote and then I rewrote again and eventually I passed all three exams.

Finding Inspiration and Motivation

I am far from the model CFA Candidate, I’m currently looking for a new job. However I outlasted and got further than many of my contemporaries. I can’t say it made me happy, but I learned a lot and I spent a long time studying and analyzing exam results. Perhaps I eventually came up with the winning combination of flashcards and practice problems, perhaps I just got lucky. If you need inspiration or motivation I collected a lot of quotations you can share them on social media and appear witty.

Did you spot the data bias?

You can leave your thoughts on the quality of the data in the comments below. The seasonality is not a problem most candidates write one exam per year, but that may change as the Level 1 exam goes electronic. Just because panicked candidates in the month before the exam are searching the Internet for a particular formula or definition does not mean it will appear on the exam, always go with what is in the current CFA Program curriculum, but can hundreds of panicked finance people be wrong?

A) Yes

B) 95% Probability of them all being wrong

C) The answer is +/- 1.96 standard deviations from the mean of the sample

This entry was originaly posted on , it was last edited on and is filed under: Advice and tagged: Analytics, CFA®, Finance.

One CommentLeave A Comment Now